Europe’s biggest banks have ploughed some US$400 billion into companies expanding oil and gas production since 2016, despite their stated commitments to Net Zero targets, according to research from Share Action.

The banks' continued love affair with oil and gas flies in the face of warnings from the International Energy Agency (IEA) – the world leading energy authority – which just last year warned there was no room for new oil and gas fields if we are to keep the world to 1.5C warming.

Not only this, it also flouts these bank’s own public commitment to the Net Zero Banking Alliance (NZBA) – an alliance of banks pledging to meet net zero emissions by 2050.

In fact, NZBA members provided at least £33 billion in financing to the top upstream oil and gas expanders since they joined the alliance last year. More than half of this was provided by four founding signatories: Barclays, BNP Paribas. Deutsche Bank, and HSBC.

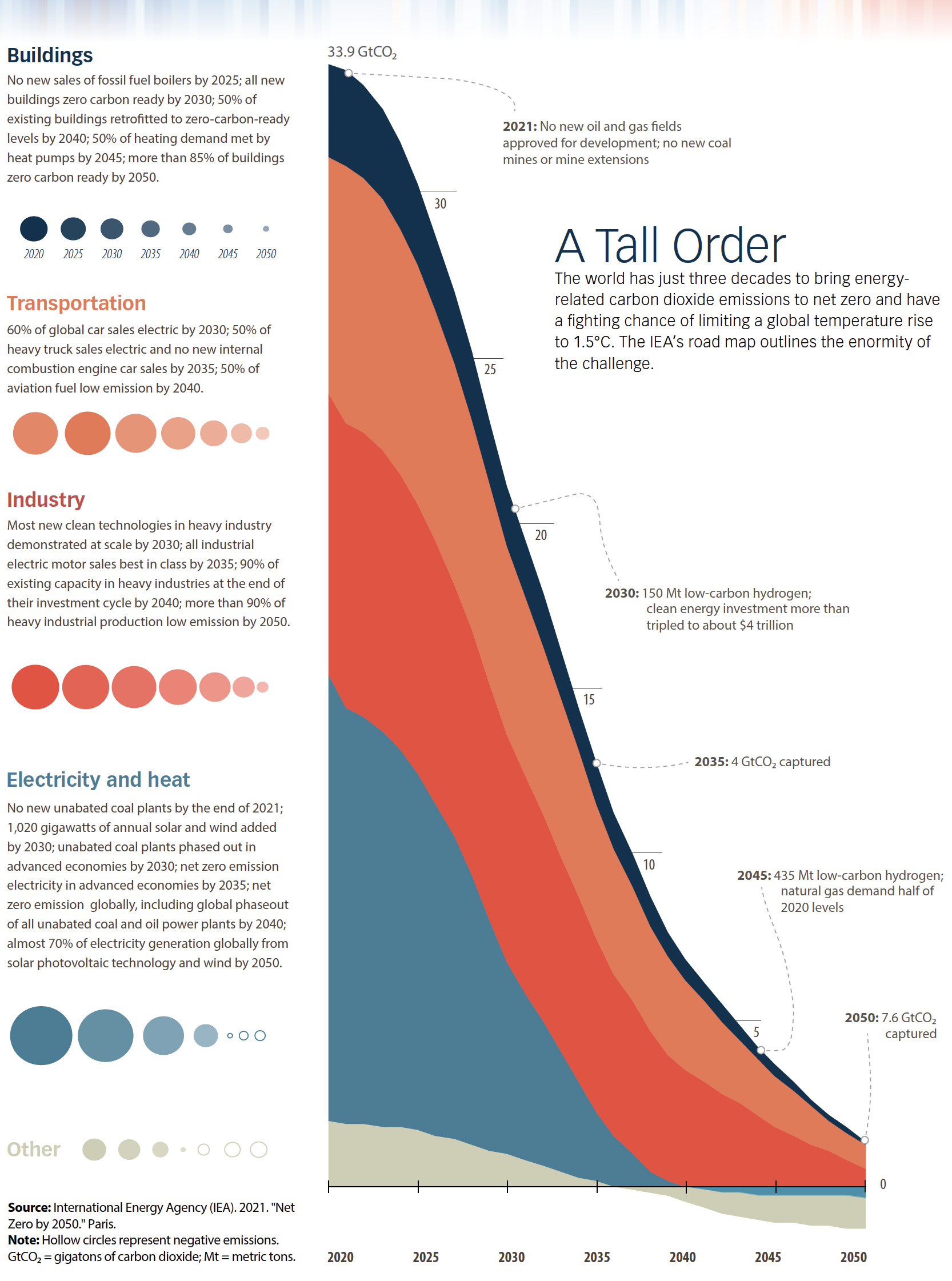

In the IEA’s net zero scenario report, published in 2021, it made clear there is no room for new oil and gas fields after 2021 if the world is to achieve net-zero emissions by 2050.

Worst Offenders

As per Share Action's latest report, ‘Oil & gas expansion: a lose-lose bet for banks and their investors’, these founding members still top the charts when it comes to financing oil and gas companies exploring new reserves and expanding production.

HSBC, for example, provided US$59 billion to top expanders such as Exxon Mobil, Pemex, and Saudi Aramco. Barclays, meanwhile, pumped $48 billion into companies with the biggest expansion plans. Exxon Mobil, Shell and BP received the most financing.

BNP Paribas, which has pledged to reduce lending to exploration and production activities, has also been exposed for its role financing oil and gas expansion companies – providing US$46 billion since 2016 and increasing financing by 16 per cent in 2021 compared to pre-pandemic levels. French peers Credit Agricole and Société Générale are also among the largest financiers.

Despite many banks making net zero commitments in 2021 or before, many have actually increased their fossil fuel expansion financing in 2021. These include Credit Suisse, ING, Intesa Sanpaolo, UBS, Nordea, and Danske Bank.

The IEA net-zero roadmap

In the IEA’s net zero scenario report, published last year, it made clear that there is no room for new oil and gas fields after 2021 if the world is to achieve net-zero emissions by 2050. Yet the majority of banks are still not even close to the IEA’s recommendations.

"This is a worrying signal to investors and the public about the legitimacy of European banks’ climate credentials," the report stated. "As banks continue to line up to make ambitious commitments to support the transition towards net zero, the devil will be in the detail. And sadly, banks don’t yet have the policies to reach their ambitions.

"Just a handful of banks restrict financing for oil and gas projects, and even less restrict for companies that are expanding oil and gas production.

"Out of 25 banks analysed, only Commerzbank, Crédit Mutuel, Danske Bank, La Banque Postale and NatWest have started restricting financing for oil and gas projects. And just three banks Commerzbank, Crédit Mutuel, and La Banque Postale have also committed to restrict financing for companies with expansion plans."

Change THIS .... click here to set the footer